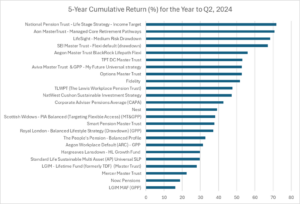

Eleven workplace pension funds grew more than the industry average over five years, according to the latest Corporate Adviser Pensions Average (CAPA) data.

Figures for the year to June 2024, showed the National Pension Trust (NPT) delivered the highest five-year cumulative returns of 71.9 percent for younger savers (people with 30 years left until they reach state pension age).

This is a much larger return than the industry average, which CAPA data revealed was 42.8 percent for the same group over the same cumulative period.

Aon MasterTrust and LifeSight funds also achieved impressive five-year cumulative returns for younger savers, with 70.8 percent and 68.5 percent respectively. (See full list of cumulative returns over 5 years for workplace pensions below).

1 percent matters

The data highlights the significance of compound returns over long periods. Even a 1 percent increase in pension performance can have a big impact on an employee’s ultimate savings pot.

The difference is clear if you compare two pension funds that start with the same amount but one grows at 5 percent annually, while the other grows at 6 percent annually.

If they both start with £10,000, over 40 years the fund that grew at 5 percent a year will reach £70,400. However, the fund with 6 percent annual growth will achieve £102,857.

In this example, the fund that grew just 1 percent more a year over 40 years has accumulated an extra £32,457 in that time.

CAPA figures show that an employee’s £10,000 investment in the NPT plan would have grown to £17,190, compared to £14,280 in an average plan and £11,620 in the Legal & General’s Multi Asset Fund.

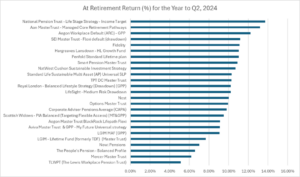

Pension performance for retirees

For people who are about to retire 15 funds performed better than the CAPA data industry average in the year to June 2024.

NPT had the best performing fund with 13.73 percent growth in the year to Q2 2024. This is a stronger return than the industry average of 9.81 percent for the same group over the same time period.

Aon MasterTrust and Aegon Workplace Default (ARC), also achieved higher than average returns for at-retirement savers, with 13.2 percent and 12.22 percent respectively. (See full list of at retirement returns below).

More about this research

CAPA data is the only source of data on performance of master trust and group personal pension (GPP) default funds that is compiled from data received directly from providers. The data is not generated from calculations or projections made from third-party sources and can therefore be considered the accurate, definitive data set on DC pension defaults.

With research covering master trust and contract-based defaults with assets totalling over £500bn, together the 20 pension providers invest assets for around 17 million active and 15 million deferred UK pension savers.

For some providers, where there are separate defaults, GPP and master trust data is provided.

This is the latest data for the year up to June 2024 (Q2) and all figures shown are after charges have been applied. For more results visit www.capa-data.com.