Government pledges that tax hikes will not appear in the payslips of “working people” were repeated at the weekend, but with an increase in employer national insurance (NI) expected in the Budget this week, one expert warned “employees might ultimately bear the consequences”.

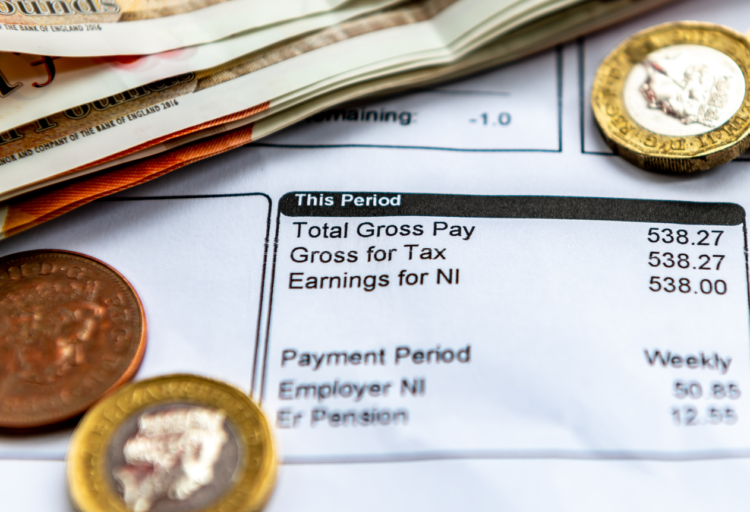

On Sunday, education secretary Bridget Phillipson told the BBC’s Laura Kuenssberg: “What we set out in our manifesto was that we would not increase VAT, national insurance or income tax on working people. And coming out of this budget, working people will not see higher taxes in the payslips that they receive. That is really important, because we know the pressures that people are under.”

However, the inference tax increases for employers would not affect working people has been described as a fiscal sleight of hand by some commentators as any increase in employers costs could have a knock on effect on employees.

Chancellor Rachel Reeves is expected to increase employers’ NI in the Autumn Budget on Wednesday 30 October to plug the £22bn black hole in public finances.

But Julia Turney, partner, platform and benefits, at Barnett Waddingham, said: “There is an overall concern about the potential impact of rising employer costs, as employees might ultimately bear the consequences.

“Many employers currently use the savings they receive from national insurance relief on pension contributions, and those made through salary sacrifice arrangements, to boost pension contributions or fund additional benefits like healthcare and life assurance. If these savings disappear, many employers could make the difficult decision to reduce or cut these benefits altogether. This is especially worrying when it comes to healthcare benefits, such as private medical insurance, as employees could be left to pick up the pieces.

“Given the ongoing health crisis, if fewer people have access to private medical insurance, this could place an additional burden on an already overstretched NHS. The budget is an opportunity for the government to take more positive steps toward addressing the health crisis, particularly as we seem to be entering a period of lower interest rates. But if this is left unaddressed come October 30th, it could raise questions about how coordinated the government’s approach really is, and whether they are merely kicking the can down the road.