A fifth of employees suffer from some level of financial avoidance, according to findings in the Aviva Working Lives Report 2024: Working for the Future.

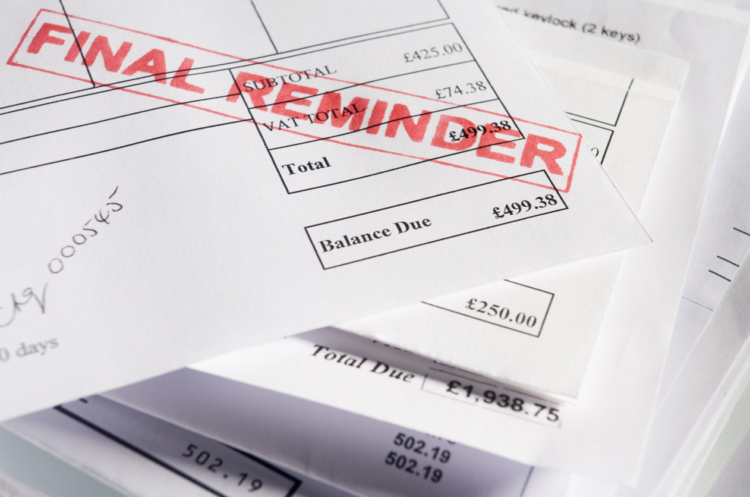

The annual investigation showed that 20 percent of workers experience financial avoidance meaning they might actively shy away from managing their finances, which can manifest as not paying bills or checking financial statements.

Financial avoidance can be driven by anxiety and the report showed that 73 percent of employees said that the cost-of-living crisis has made them feel more anxious about their finances.

Financial wellbeing

However, only 56 percent of employers think their staff are worried about their financial wellbeing. Aviva said this might be because people are not talking about it, with 50 percent of employees reporting that they have not talked to their current employer or line manager about their financial wellbeing.

The report found that employers are supporting their workers as 76 percent have initiatives in place to encourage employees to talk to their managers about financial concerns, which Aviva said was encouraging.

Findings also found that 21 percent of employers do not actively encourage people to discuss financial concerns, although this was an improvement from 34 percent last year.

Family and friends

Employees are more inclined to talk to friends or family about financial anxiety with 49 percent reporting this. In contrast, only 6 percent talk to colleagues or a manager and 6 percent consult a financial adviser. However, 14 percent don’t have any coping mechanisms like this.

The report found that younger people are more likely to talk about their financial concerns, while older people are more likely to not have any coping mechanisms.

Emma Douglas, director of workplace savings and retirement said: “Financial wellbeing is a critical part of a person’s welfare, and it might be a surprise to some that it is more about a person’s attitude to money and how they feel, rather than a number in their bank balance or pension fund.

“These attitudes can be based on a range of factors, including a person’s experience of handling money, their background, and their level of personal finance knowledge.”

Mental health

Douglas continued: “If someone is anxious or stressed about money it’s likely to have a detrimental impact on their mental and physical health too. Employers are increasingly looking to offer information and a range of support services and tools designed to help improve the financial wellbeing of their people. But individuals’ needs vary hugely, so it’s important that services can be tailored to support these diverse needs: from help with bills and budgeting to retirement planning.”

She said that people can take small steps to manage their financial wellbeing, such as tracking down lost pensions, making a plan for retirement, or checking whether their employer provides an employee assistance programme (EAP).

Some employers offer financial education via a specialist provider or an EAP, and there are a number of 24/7 helplines and online resources offering information about financial issues.

For example, Aviva recently launched its ‘Find and Combine’ pension tracing service. It also provides a range of online retirement tools and calculators.

Further financial support is available through Pension Tracing Service, Money and Pension Service, MoneyHelper, and Pension Wise.

Douglas said: “At Aviva, we’re developing a new online financial wellbeing tool which – once it’s ready – will use technology to deliver more personalised support for our corporate workplace pension scheme customers. It will offer an action plan and a series of tangible bitesize steps — education guidance, advice, or coaching services — that can address current financial needs and help reduce stress and anxiety around money issues.”