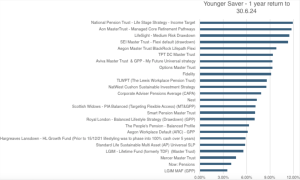

LifeSight and Aon MasterTrust, along with SEI-owned NPT, delivered returns exceeding 20% for younger savers in the year to 30 June 2024, according to the latest Corporate Adviser Pensions Average (CAPA) data.

The CAPA provides a comprehensive view of default pension fund performance by assessing returns for 18 million active and 13 million deferred UK savers. It calculates the average percentage of gross returns before charges across all default funds in its dataset, offering an overall performance snapshot without factoring in fund size, risk, or individual charges.

Recent figures for Q2/24 show LifeSight’s Medium Risk Drawdown with a 25.2% return and an 11.5% five-year annualised return. NPT achieved a 20.6% return with an 11.94% five-year return, while Aon had a 20.2% return and an 11.8% five-year return. The CAPA average for younger savers was 16.61% for one year and 7.88% for five years.

Legal & General’s Multi Asset Fund returned 9.56%, while its Lifetime Fund returned 13% over the same period.

SEI Master Trust and NPT led with five-year returns of 8.45% and 7.68%, respectively, while Fidelity’s FutureWise default had the lowest at 2.4%. The CAPA average for older savers was 12.55% for one year and 4.98% for five years.

In the year ending June 2024, NPT, Aon, and Aegon’s ARC GPP defaults had the highest returns at 14.2%, 13.7%, and 12.7%, respectively. CAPA’s one-year return was 10.3%, and its five-year return was 3.51%.

Hargreaves Lansdown had the lowest five-year return of 1.02% but recently improved to 11.5% with a new strategy.