The 2024 Autumn budget has put salary sacrifice in the spotlight, and the advantages, for many, are there for all to see, says Steve Watson, director of policy and research at Natwest Cushon.

This year’s Autumn budget brought in a massive increase to employer national insurance (NI) costs from April 2025. It’s effectively a double whammy: the actual rate is increasing from 13.8 percent to 15 percent, and the secondary threshold is dropping from £9,100 to £5,000. A lot more of everyone’s salary will be subject to employer’s NI and at a higher rate.

Just the reduction in the secondary threshold means an increase of £615 a year for lower paid employees. It’s a huge increase.

Independent research we conducted among 500 HR decision makers just before the budget (from 25 to 30 October with Censuswide) indicated that most employers, from small to large, would need to do something to mitigate these increased costs. That includes potentially reducing pension contributions where levels were above the auto enrolment minimums. While there is unlikely to be a single silver bullet to help address these increased costs, there is one solution that arguably should be implemented by businesses before any others. It’s simple, has zero direct implementation costs, and it benefits employees to boot.

That’s salary sacrifice or, as we like to call it, salary exchange.

We are caught in a perfect storm. On the one hand, employees are battling with day-to-day living costs and, from April 2025, employers will need to cover increased NI costs. Salary sacrifice helps with both problems.

What is salary sacrifice?

Simply, salary sacrifice is a way of swapping some of an employee’s gross salary by an amount equal to their pension contributions. The employer then pays the total pension contribution instead, saving both the employee and the employer money in lower NI contributions. While it makes someone’s salary look smaller (hence the name) their take home pay is higher, due to the NI saving, while their pension contribution remains the same.

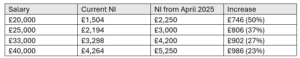

Although the reduction in the secondary threshold (from £9,100 to £5,000) was not the headline grabber, it accounts for the majority of increased costs – £615 a year for most employees. The table below gives you an idea of the increased employer costs across different earnings bands.

The figures in the table are based on a 5 percent employee pension contribution of the same salary in each example, employment allowance discount where appropriate, and assume salary sacrifice is not currently used.

Based on the salary range above, for a business employing 50 people this could mean a total increase of anywhere between about £31,790 and £38,790 a year. This range of collective savings also factors in the discount from the employment allowance.

The employment allowance is effectively a discount given to smaller employers on their total NI cost, which means a company whose NI bill in the previous tax year was less than £100,000. The discount available will increase in April 2025 from £5,000 to £10,500, and the £100,000 threshold will be removed, so the increased discount is available to all employers. This is a big win for smaller companies and means, according to the government, that about 865,000 businesses will not have to pay any NI costs.

The business case

Considering the increase in employer NI costs from 6 April 2025, 90 percent of the companies we surveyed indicated that they are now likely to take action to mitigate the additional expense. Around 30 percent said they would consider reducing pension contributions, while 28 percent would look at reducing the costs of other employee benefits.

This response is understandable, but it comes at a time when there is wide recognition that average pension contributions are already too low and both employer and employee contribution levels need to increase.

Salary sacrifice has the advantage of bringing benefits to employees in respect of increased take home pay while maintaining contribution levels and also securing much needed cost savings to employers. It’s a win-win.

For instance, a company employing 50 employees each earning £33,000 a year is looking at a £35,000 increase in NI costs from April. Assuming a 5 percent employee contribution rate, salary exchange can bring that increase down to about £22,000 – and put an extra £132 a year into each employee’s salary.

Salary sacrifice does effectively reduce someone’s salary, and this can affect benefit entitlements like maternity/paternity pay, and mortgage applications based on income. It may also not work for those on low incomes because salaries are not allowed to fall below the national minimum wage.

It’s vital that employers explain clearly how salary sacrifice works and highlight the scenarios where it may not be right for some people. It is then up to the individual employee to decide if it works for them.

What is clear is that salary sacrifice will become a bigger consideration for employers from April 2025. The business case has grown stronger, the arrangement is easy to implement, and it saves money for both employee and employer.