Insurers that provide employer-sponsored group risk protection for employees paid £2.68 billion in claims in 2024, according to data from the Association of British Insurers (ABI) and Group Risk Development (Grid).

The data showed that for combined group claims and single policies, bought by individuals rather than their employer, insurers paid out over £8bn in claims, representing a record payment figure.

Data for group and individual risk protection policies showed that the total value of claims paid for critical illness (CI) was £1.4bn, with the average claim worth £68,735.

Life insurance (LI) was split into two categories with ‘term LI’, which covers the policyholder for a specified number of years, usually until retirement age, seeing insurers pay claims worth £4bn in 2024. In this LI category the average claim was £79,703.

The second category, ‘whole of LI’, covers the policyholder until they die and is also known as ‘life assurance’. This cover accounted for £1.5bn of all claims paid, with an average claim valued at £7,408.

Group and individual income protection (IP) claims paid were valued at £969m, with the average value of claims paid worth £25,133.

Another product included in the combined group and individual claims data was ‘total permanent disability’ policies, which saw insurers pay £33m in claims in 2024. The average claim for this cover was £82,052.

Extrapolating the employer-sponsored data, figures suggest that group CI claim payments totalled £143m in 2024, while group IP payments were valued at £765m. For individuals buying this cover, CI claim payments were valued at £1.3bn (up 5 percent on 2023), and IP payments were valued at £204m (up 16 percent on 2023).

Data for individual policies was more comprehensive, with the two industry bodies reporting a 10 percent increase in the total value of individual claims paid in 2024 compared to 2023. This is despite the number of individual claims in 2024 remaining steady at 275,000. The average claim paid rose by 10 percent to £18,700 compared to £17,100 in 2023.

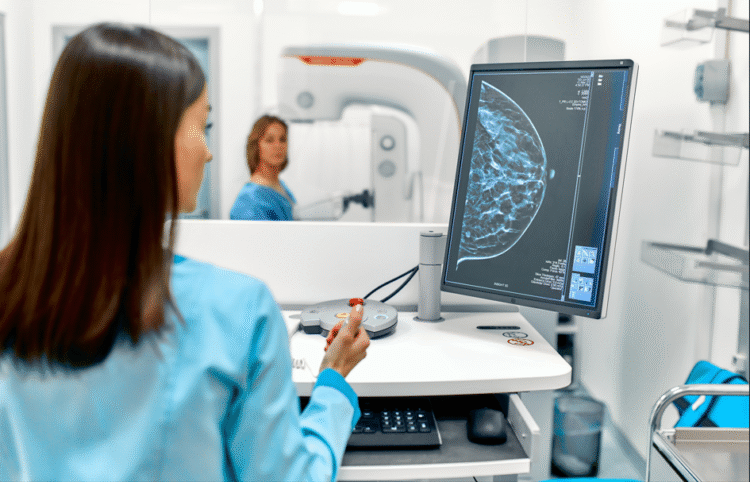

In the individual policy CI category, cancer was still the most common reason for an insurer to pay a claim, representing 62 percent of all claims paid. Payment for the condition reached £812 million, up more than 4 percent from 2023.

Within individual IP claims, musculoskeletal (MSK) issues such as neck and back pain remained the leading cause for insurer claim payments in 2024. MSK accounted for 34 percent of claims paid and at least £32 million in payments.

Insurers said that the proportion of individual policy claims paid remains high at 97.9 percent.

Common reasons for claims being declined were policyholders failing to disclose existing medical conditions when they took out the policy, and not meeting the policy definitions.

Rebecca Ward, assistant director and head of health and protection at the ABI, said: “Behind every protection insurance claim is a person or someone close to them having to navigate a significant illness, injury or loss. The financial support these products can provide is a lifeline for those who need it, when they need it most.”

Commenting on the total combined group and individual protection policy claims paid, she said: “With nearly £22 million paid in claims every day in 2024, protection insurers remain committed to helping people recover when faced with serious illness or grief.”

Clare Lusted, head of product proposition at Unum UK, commented: “It’s reassuring to see that, when individuals and families are in moments of crisis, insurance providers are stepping up with increased support. These emotionally and financially traumatic experiences demand compassionate and efficient responses, and the latest data shows the industry is rising to that challenge. Workplace protection products are evolving; not only to safeguard finances, but to proactively support people’s health, happiness and productivity. When illness, injury or loss disrupt daily life, it’s encouraging to see the insurance industry enable people to focus on healing and help restore a sense of wellbeing.”