More than half of UK employees (53 percent) say they feel the need to take time off work to deal with personal administrative tasks, research has revealed.

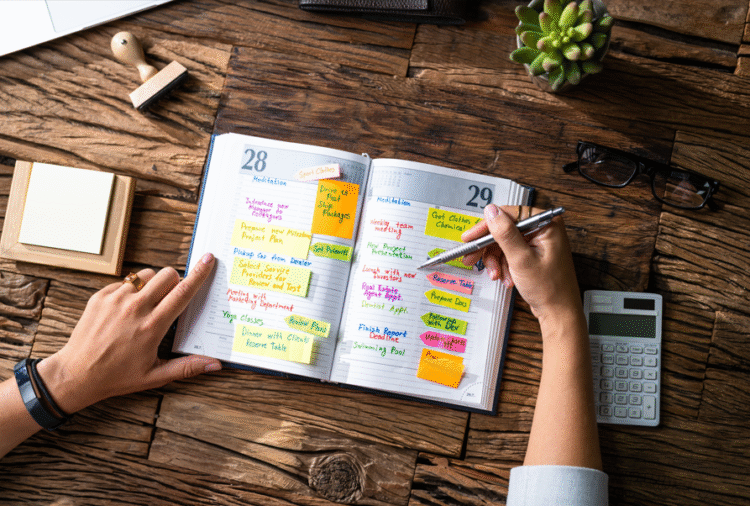

The survey of 2,000 adults, conducted by Confused.com to mark National Work Life Week (6-12 October), found that ‘life admin’ (which can include booking appointments, paying bills and catching up with washing) is piling up.

Close to three quarters (72 percent) admit to putting off such tasks, while Google searches for ‘life admin checklist’ and ‘life admin day’ have risen by more than 100 percent in the past year.

The most delayed task is making medical appointments, with 36 percent saying they have postponed them. This was followed by cancelling subscriptions (32 percent) and writing or updating a will (25 percent). Other tasks commonly delayed include renewing passports and switching energy or broadband providers (both 19 percent).

While most respondents (94 percent) said they have considered the consequences of an unexpected event such as illness or loss of income, fewer are taking practical steps to prepare. More than one in ten (11 percent) have delayed arranging life insurance, and almost a third (31 percent) are unaware that sorting it earlier can save them money.

Confused.com found that taking out a life insurance policy in your 20s instead of your 60s could save more than £440 a year on average, with monthly premiums over 70 percent cheaper.

Tom Vaughan, life insurance expert at the financial services comparison website, said: “It can be difficult to balance ‘life admin’ amongst other everyday tasks, which is why it’s more important to prioritise tasks that will provide you with emotional and financial security.

“Anything that involves your health, finances, or your loved ones should always be at the top of your checklist, especially when it comes to things like life insurance. The tasks that take the most time, cause inconvenience, or require us to think about difficult situations are often the ones we’re most likely to avoid. That’s why it’s worth tackling them early.”

He added that breaking tasks down into smaller steps can make them more manageable:

“If you’ve got a list to get through, try to get through one task a day rather than overwhelming yourself trying to do it all at once.”

The findings highlight the growing pressure on employees to juggle work with personal responsibilities, and the importance of supporting flexibility and wellbeing during working hours.