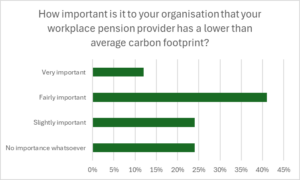

More than half (53 percent) of HR professionals say that it is very or fairly important to their organisation that their workplace pension provider has a lower than average carbon footprint, according to exclusive research from Benefits Expert.

The poll of HR, reward and benefits professionals was conducted at this year’s Benefits Expert Summit, held in November.

Earlier this year, data published in the Benefits Expert Guide to Understanding Sustainability in Workplace Pensions revealed that defined contribution (DC) pension funds have significantly reduced the carbon footprint of their investment portfolios.

DOWNLOAD THE BENEFITS EXPERT GUIDE TO UNDERSTANDING SUSTAINABILITY IN WORKPLACE PENSIONS HERE

The detailed study of 20 major pension providers showed that seven of them have reduced the carbon footprint of their DC funds by 50 percent or more in the past year.

As a result, the average carbon footprint of DC pensions is now 61.1 tonnes of carbon per million pounds sterling invested.

With the majority of HR professionals viewing greener pensions as very or fairly important, it is timely that DC pensions are emerging as a leading sector for reducing the carbon emissions tied to their investments. The sector is also offering greater transparency on carbon metrics than most other areas of financial services.

The data also offers reassurance to those concerned that more sustainable investments might dent returns. It found no evidence that lower carbon outputs negatively affect financial performance. However, there was significant variation between providers.

Among the 20 schemes analysed, carbon footprints ranged from 23.4 tonnes per £1 million invested to a striking 108 tonnes. These differences often stem from differing investment portfolios, reporting metrics, and the timing of disclosures.

Larger pension trusts, bound by Taskforce on Climate-Related Financial Disclosures (TCFD) rules, must report detailed sustainability data, but the timelines allow up to seven months after the scheme year-end. This means some published figures may lag by almost a year.

Yet the potential for pensions to cut carbon emissions remains compelling. Research by Make My Money Matter suggests that choosing an ESG-friendly pension can reduce an individual’s carbon footprint 21 times more effectively than going vegetarian, quitting flying, and switching energy providers combined.

DOWNLOAD THE BENEFITS EXPERT GUIDE TO UNDERSTANDING SUSTAINABILITY IN WORKPLACE PENSIONS HERE