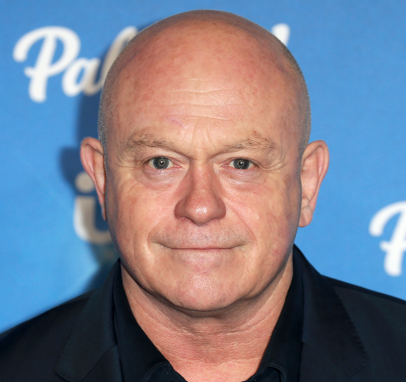

TV star Ross Kemp has teamed up with financial coach Bola Sol to front the fourth Pension Attention campaign, as they pump iron and urge people to “strengthen your pension”.

The industry-led engagement initiative, coordinated by the Association of British Insurers (ABI) and Pensions UK, encourages savers to take simple, practical steps to improve their retirement readiness. Supported by many of the UK’s biggest pensions brands, the 2025 campaign uses the language of fitness to highlight how small actions now can deliver long-term financial benefits.

Kemp appears in a fitness-themed advert urging people to “gain pounds” for the future, against the backdrop of research suggesting people prioritise their physical health over financial wellbeing. Nearly one in five (19 percent) UK adults say getting fit and healthy is more important to them than saving for later life.

The research also found that, over the past year, 37 percent of people have made a lifestyle change such as improving their diet or sleep, while 30 percent have set a new health or fitness goal. By contrast, fewer than one in three (29 percent) have organised their finances for retirement. The survey highlights that adults are more than twice as likely to track their daily steps or hours of sleep than to check their pension balance.

The campaign sets out a three-step plan to boost retirement preparedness. First, ‘stretch your mind back to any past employers or pensions’, then ‘check your form by logging into your pensions to see how much you have’, and ‘work out how much you might need for the future’.

Kemp said: “A lot of us care about getting fit for the future, that’s why we hit the gym, eat better, and try to sleep more. But your pension is part of that too. With an easy three-step training plan, you could strengthen your pension and gain some serious pounds. Do your future self a favour and pay your pension some attention.”

Sol added: “Planning for retirement is a lot like getting fit: you can get the best results by starting early and sticking with it. Although people are enrolled in a workplace pension scheme, many lose track of old pots and don’t pay into them regularly. If you do one thing today, take some time to track down any pensions you may have paid into in previous jobs.”

Minister for pensions Torsten Bell said: “Most people check their fitness apps more than their pension balance, but both are important for a healthy future. We’re ramping up the pace of our pension reforms to make saving easier and ensure you get the most from every pound you’ve saved.”

Mark Smith, spokesperson for the Pension Attention campaign, said the aim was to “align physical and financial fitness” to spark engagement among 35-55-year-olds who are already making health-conscious lifestyle choices but have yet to turn the same attention to long-term financial planning.

Previous campaigns have been fronted by Big Zuu, Timmy Mallett and Gemma Collins. Organisers urged employers and providers to help promote the “pension fitness plan” and support colleagues in getting retirement ready.

Simon Ellis, director of workplace pensions at Aviva, also underlined the importance of early action: “Less than half of mid-retirees feel confident their private pension will last a lifetime. Paying your pension some attention now, knowing what you’ve got, how it’s working for you, and whether you’re on track, can make all the difference later.”